Shariah Compliance

Shariah Compliance

Dar Al Tamleek's Shariah Board was established as the authoritative body for determining Shariah compliance. To ensure consumer confidence in the interpretation of Shariah principles, the Shariah compliance process is:

Periodical

The committee meets four times per year to review all policies, procedures, contracts, and products

Up-To-Date

Each program or enhancement is reviewed with the same stringent guidelines in order to provide consistency and consumer confidence

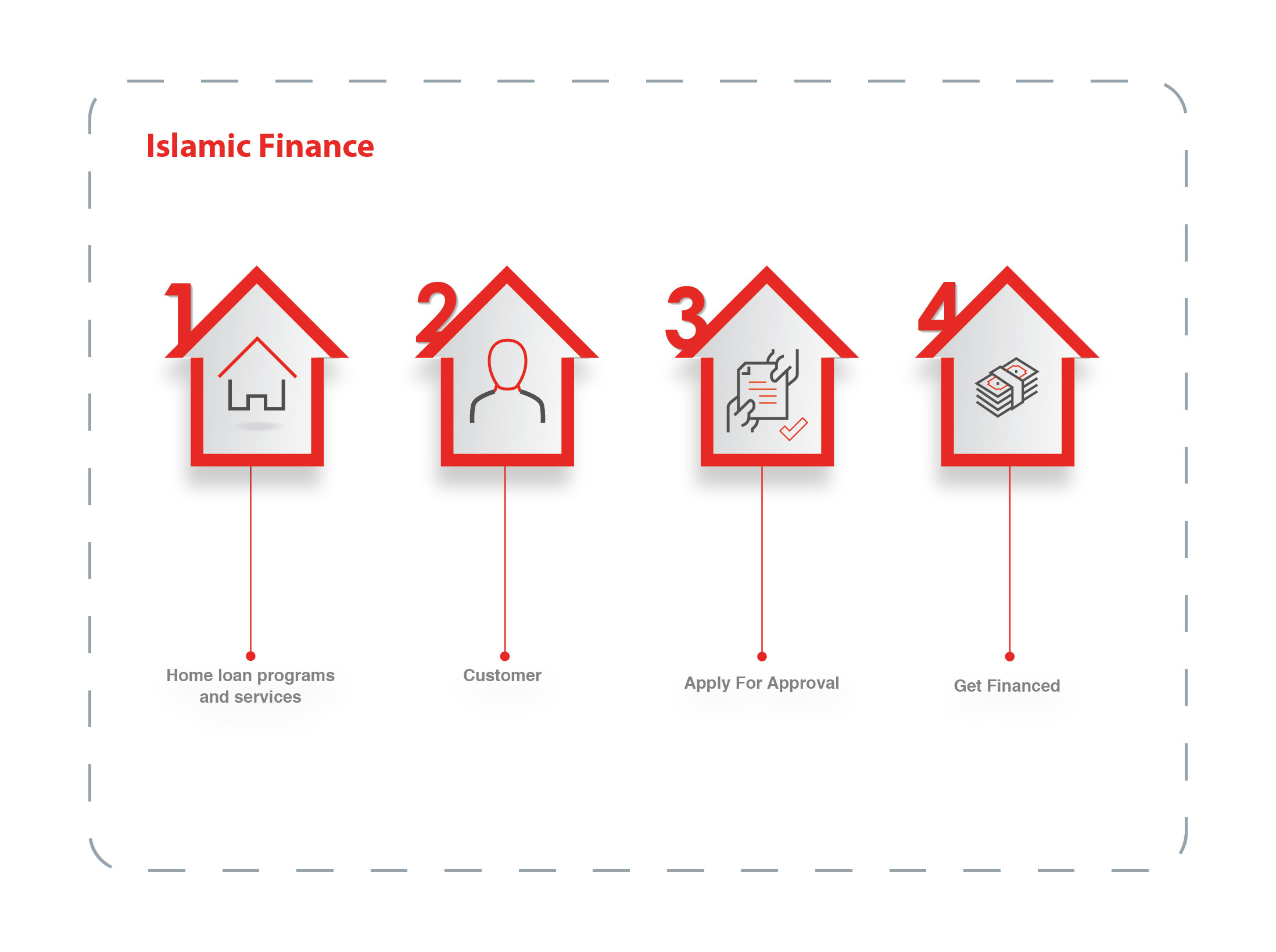

Islmaic Finance

How it Works?

Murabaha

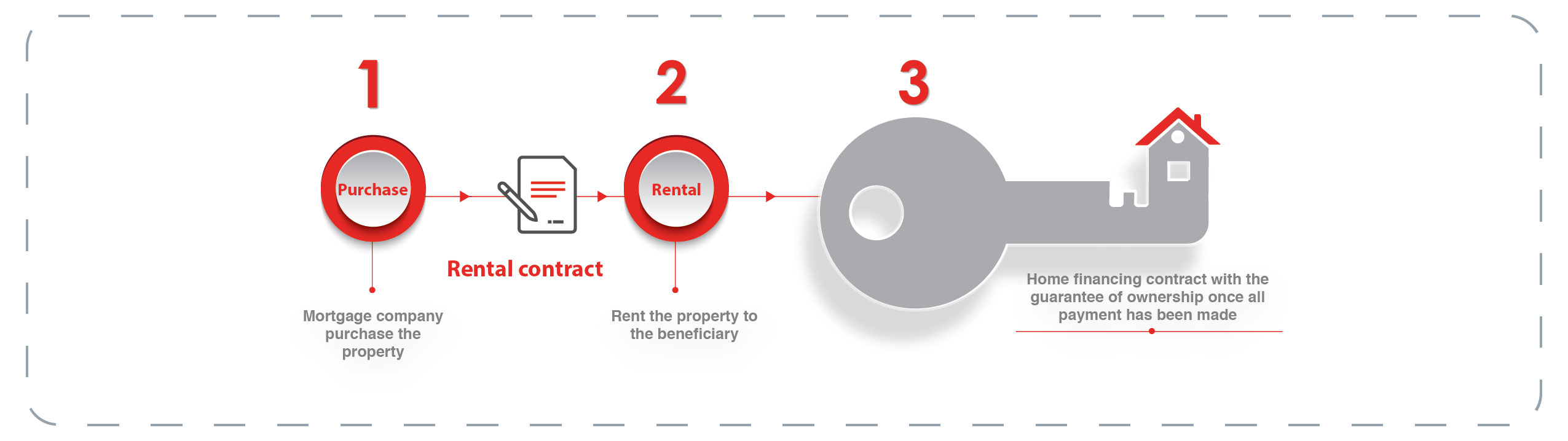

Ijarah

| Shariah Compliant Contract |

| Parties in Contract | Three parties: Dar Altamleek, Seller of Property, owner |

| Number of Contracts | Two contracts: Ijarah contract with the promise of ownership and the other is Murabaha |

| Property type | Apartment/ Land/ House |

| Considerations |

|

Types of Islamic Loans

There are basically 5 basic types of Islamic home loans:

- Mudarabah, which is similar to a partnership, where one partner lends money to another so they can invest in a property. The first partner invests with his money, while the other has the responsibility to manage and work on the investment.

- Murabaha, where the lender will buy the property for you and will sell it back to you immediately for a profit. You pay fixed monthly repayments on the higher price without paying any interest back to the bank.

- Ijara, where the lender buys the property and leases it to you, transferring ownership to you once the loan term ends.

- Musharaka, where you and the sharia-compliant lender buy the property together and you gradually buy them out of their share. The more shares you own the less you have to pay back.

- Wakala, where you make an agreement with the lender to work as your agent, allowing them to use your money to invest in sharia-compliant trading activities to generate a target profit for them.

Murabaha Vs. Ijarah

The main difference between these two types is that with a Murabaha mortgage the property will immediately be registered in your name, while with an Ijara mortgage, you can only rent the property from your sharia-compliant lender, where you'd have to pay a monthly rent and at the end of the agreed term or once the purchase price has been repaid in full, the ownership of the property will be directly transferred from the lender to you.

Forbidden Home Loans

Forbidden home loans in Islam are the ones that involve interest which is considered (riba), it's not permissible except in cases of urgent necessity which cannot be met except by taking out a riba-based loan. Purchasing a house does not reach a high level of urgency because this need can be met by renting instead. You can rest-assured that DAT does not offer any riba-based loans.

Dar AlTamleek Sharia Committee

Shariah Board Members

Our Shariah is represented by reputable members who come with an extensive experience in Islamic financing.

Sheikh Dr. Abdullah Bin Mohammed Mutlaq

Holds his Ph.D. from Imam Mohammed Bin Saud University, Saudi Arabia and is a member of the Senior Ulema Board and Ifta Committee. He sits on the Shariah Boards of many banks in Saudi Arabia including that of Saudi American Bank, Riyadh Bank, and AlJazirah Bank. He has compiled a number of fatwas and has written a number of books on Islamic contract law.

Sheikh Dr. Bilgassem Bin Thaker Mohammed Alzubaidi

He has earned PHD degree in Sharia Major (Usoul Al-Fiqh) from Umm Al-Qura University with an excellent grade with honors and a recommendation to print the thesis and circulate it among universities. Also he has earned Master's degree in Sharia specializing in (Usoul Al-Fiqh) from Umm Al-Qura University with an excellent grade, honors and a recommendation, in the printing of the thesis. and a Bachelor’s degree in Judicial Affairs from Umm Al-Qura University, graded excellent, with honors.

Forward Ijarah Fatwah

Forward Ijarah Fatwah